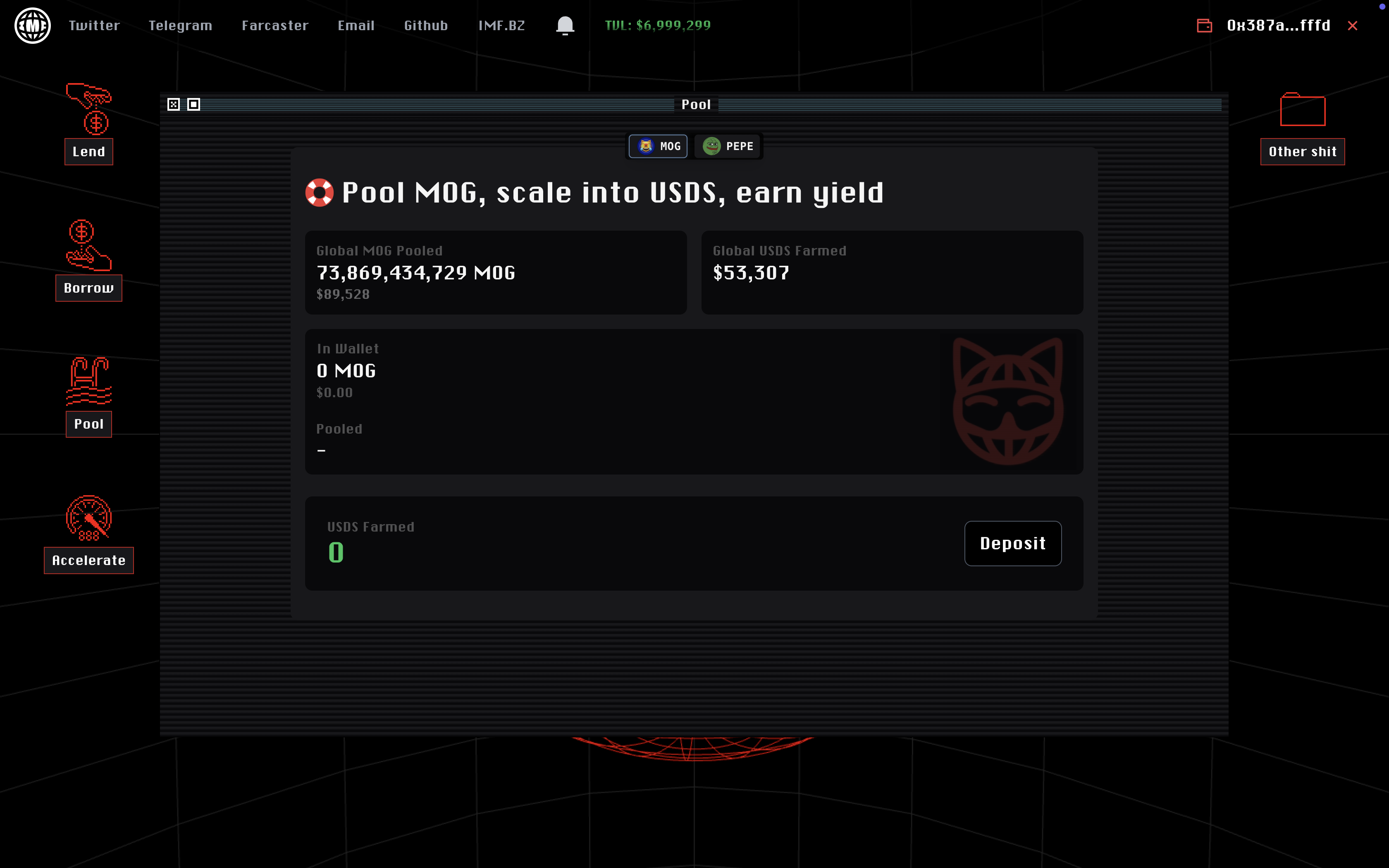

Pool

Auto-DCA into USDS yield via optimized Uniswap LPs

For whales, selling causes red candles. Chaos. Reputational damage. But whales still deserve their dues. That’s why IMF built an elegant exit. Using IMF Pools, whales can DCA out gradually through credit markets - a safe, steady path instead of panic. Bonus: whales earn yield while doing so, and bolster liquidity for those who remain.

For founders and projects, you can launch your own credit pool. Give holders a reason to hold, loop, and support the project. No emissions. No grants. Just real liquidity earned, not airdropped.

When a token is deposited into Pool, it’s paired with USDS in a protocol-optimised Uniswap v3 liquidity position. This isn’t a farm. It’s structured liquidity, designed to generate real fees and enable lending.

How it works

- Users deposit a token into the Pool

- The protocol deploys it into a Uniswap v3 position against USDS

- LP fees are earned passively

- USDS is periodically streamed out to fund the Borrow market

You deposit a single token: no need to pair it with USDS or manage an LP manually. The protocol handles the strategy and rebalancing on your behalf.

Why it matters

- Bolsters credit market liquidity

- Earns fees from real market activity

- Feeds the flywheel for borrowers

Pool is the gateway for whales to participate in IMF and deliver a positive-sum outcome for their community. It’s where passive holders become active participants in a community coordinated credit market.

The only no-sell, yield bearing, credit market strengthening exit strategy.